Zonda Media recently released the 36th annual Cost vs. Value (CVV) report detailing the home renovations that deliver the best return on investment (disclosure: Zonda Media owns JLC). True to form, this year’s report confirms a consistent truth that has been revealed on every report for the last 30 years: Exterior replacement projects typically provide a higher return on investment than interior discretionary remodels at the time of house sale.

The value figures are derived from a survey of more than 6,000 Realtors. The survey supplies them with project specifications and cost estimates, along with photos and illustrations describing the projects, and asks for each remodeling project: “What value does this project add to the sale price of a home?”

The reason for high returns on exterior projects stems from what real-estate professionals regularly witness from buyers: If their first impression is a run-down exterior, they tend to enter the property wary and reluctant to spend large on the property. If, on the other hand, the home looks well taken care of, they enter with a more positive view from the outset.

This year, there are two exceptions to the rule that exterior projects rate higher: a minor kitchen remodel and a midrange bath remodel. The report suggests the average seller can expect an 86% return on a light touch to the kitchen, and 67% on a modest bathroom reno. Here, too, the rationale stems from how buyers are likely to feel, especially in today’s tight economy. Buyers are hyper-focused on hanging onto extra cash right now, especially if buying a house has put a big dent in their savings. They want workable kitchens and baths and don’t necessarily want to take on an interior remodel before they move in.

Larger discretionary projects, such as upscale kitchen, bath, and primary-suite remodels, don’t influence the value of the home nearly as much. That’s because a “dream kitchen” or “luxury bath” conceived by a former owner may not include the finishes and selections that all buyers will value highly. There are vast differences in aesthetic tastes; one person’s elegant new kitchen or bath will not be viewed by all prospective buyers equally. These discretionary projects do have great value for the owners who make the selections, reflecting a different kind of value—the satisfaction in living in their dream home. This underscores an important point: The CVV report is specifically about establishing just one type of value—the dollar value at the time of sale. Remodelers often describe using the CVV report to open a discussion about budget for proposed projects. It can be reassuring to many prospective clients to know what a project might return if they must sell their property. Once the investment has been established, remodelers report having an easier time talking about other values a proposed project might have for clients.

The Hottest Trend

New for 2023 is the HVAC conversion project. This project details removing an oil or gas furnace and replacing it with an electric heat pump that is appropriate for the climate zone. The CVV report shows that not only is this a popular project, but it also offers an exceptionally high return on investment (104%).

The trend toward home electrification has been gaining momentum in recent years. According to recent Energy Information Administration (EIA) data, electricity has surpassed natural gas as the largest residential energy source, with space conditioning accounting for the highest proportion of home energy use.

The EIA also reports that a growing proportion of the electricity generated in the U.S. is coming from renewable sources. Expanding this proportion while reducing fossil fuel emissions is viewed as a viable solution to reducing greenhouse gas emissions and alleviating climate change. However, climate warming is not the only issue driving the push toward electrification. Energy independence, which the war in Ukraine has brought into sharp focus, is also a growing concern for which electrification offers a solution.

Independent from global problems, heat pumps have grown in popularity because they provide both heating and cooling. The conversion from a furnace or boiler to a heat pump provides the added value of summertime cooling without a separate air conditioner. New inverter technology has also made heat pumps viable for heating in northern states, erasing the discomfort problems that previously plagued their use in cold climates.

A Roiling Economy

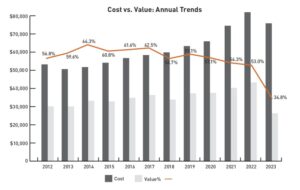

The most noticeable trend in the 2023 CVV report has been the plunge in the overall ROI numbers. While the projects with the highest returns have edged over 100%, those at the lower end of the ROI range have dropped well below 50%, with the overall cost–value ratio down to 34.8%, the lowest in the history of the report. The previous low for the CVV (a ratio of value over cost) was 56.8% in 2011–12, on the heels of the Great Recession.

Todd Tomalak, who leads Zonda’s Building Product Research and Advisory Practice, reminds us that, for the 2023 CVV report, Realtors were surveyed in Q4 2022 at what was unquestionably the nadir of the real estate market. Mortgage rates were rising while inflation was surging, and real estate sales were falling. “It was the darkest hour of 2022 and for real estate in a decade,” Tomalak explained. “But it provides an important perspective to capture. We learn what projects maintain a premium to homebuyers when times are tough, and they can’t afford everything on their wish list.”

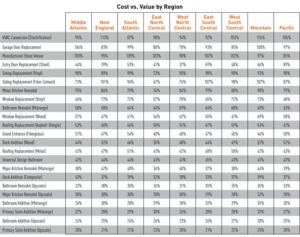

The chart above showing regional variations reveals wide differences in cost and value (one startling example is the entry door replacement project). Tomalak believes these fluctuations are likely driven by a combination of resolving supply-chain backlogs plus housing markets cooling at very different rates—a sign of a turning market where not all the markets are at the same stage. “We have seen this sort of pricing data emerge several other times; it is usually a phenomenon that occurs in ‘inflection’ points around business cycles (in this case, the housing cycle),” Tomalak explains. “The volatility that we are seeing in building product costs (and housing) since 2020 had more outliers in price/cost data than any time over the last 70 prior years cumulatively.” Tomalak says this has occurred at other times when there were severe whipsaws and product shortages (he cites WWII, the 1910s, and the 1920s as examples). These were markets where the fundamentals of supply and demand were distorted in some major way, and thereby the range and volatility of pricing were markedly inconsistent, Tomalak says.

Source: https://www.remodeling.hw.net/